Filecoin (FIL) continued its steady advance this week, posting gains of nearly 3% over 24 hours and trading at $2.44 during the latest session. The move, supported by above-average volume, underscores institutional interest and solidifies a base of support even as the token approaches resistance. Broader crypto markets also advanced, with the CoinDesk 20 Index rising 2.7%, highlighting risk-on sentiment across digital assets.

Market Reaction and Technical Setup

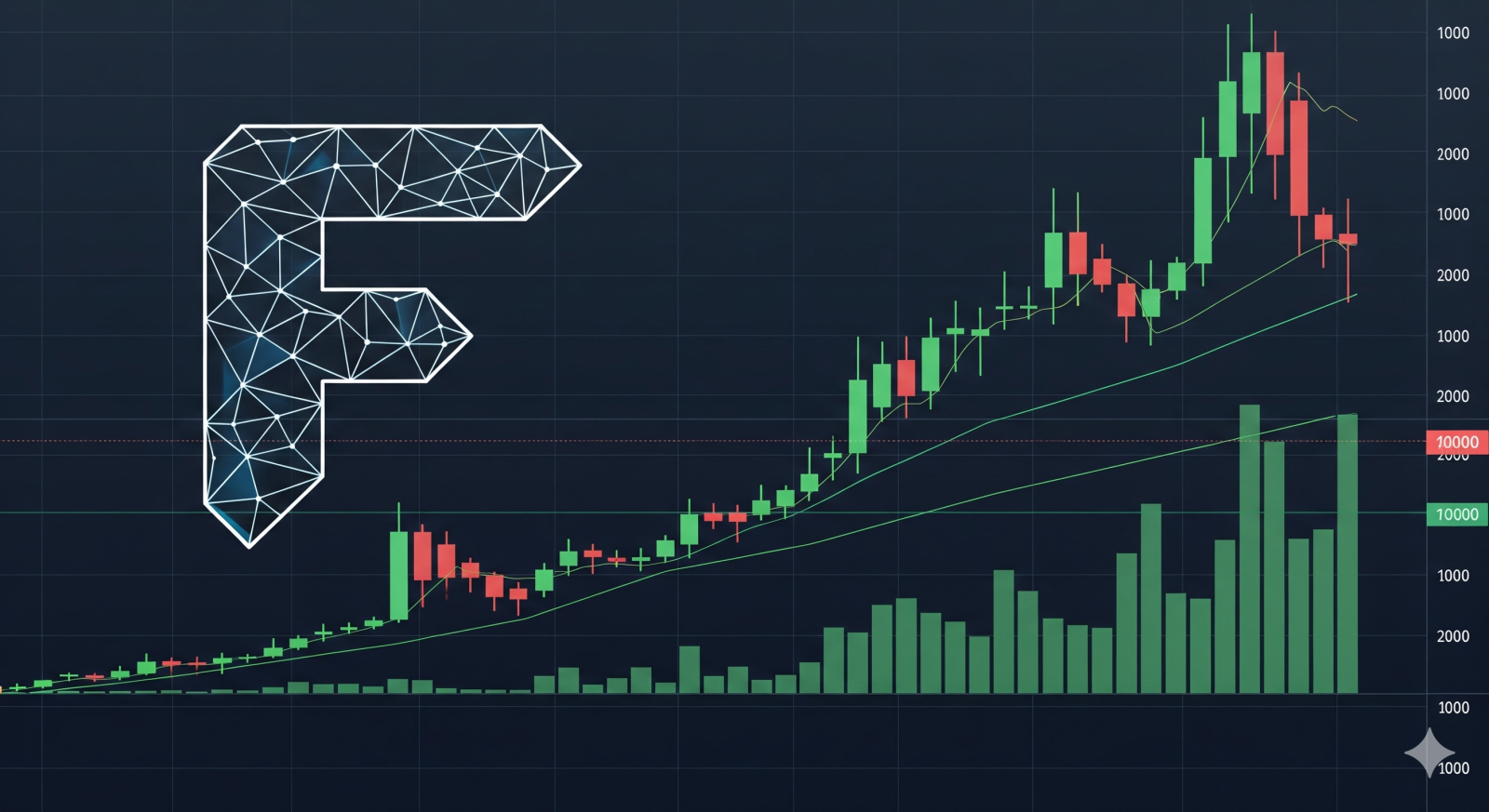

According to CoinDesk Research’s technical analysis model, FIL advanced from $2.38 to $2.44, carving out support in the $2.38–$2.39 range. Trading activity spiked dramatically at 6:00 a.m. ET, when transaction volume hit 7 million units, nearly triple the 24-hour session average of 2.35 million. The surge aligned with a rebound from $2.398, reinforcing the significance of this support zone.

Resistance formed at $2.46, where price discovery faced rejection during the same high-volume window. This level now represents a key ceiling that traders are watching closely, with momentum expected to consolidate unless additional buying pressure emerges.

Volume Dynamics and Investor Behavior

Volume trends are reinforcing the bullish narrative for Filecoin. Sustained turnover above average levels during advances suggests larger, possibly institutional players are accumulating positions. This accumulation pattern aligns with broader risk appetite in crypto markets, where investors have shown willingness to rotate into mid-cap tokens beyond Bitcoin and Ethereum.

For traders, the strong confirmation of support at $2.38–$2.39 provides a technical anchor, while the $2.46 barrier sets a short-term hurdle. Investor psychology is being shaped by the expectation that breaking through resistance on strong volume could unlock further upside momentum, while failure to do so may trigger consolidation around current levels.

Broader Market Context

Filecoin’s upward move comes against the backdrop of a broadly positive crypto market. The CoinDesk 20 Index gained 2.7% over the past 24 hours, mirroring improved sentiment across risk assets as investors anticipate a potential shift in global monetary policy. Macroeconomic uncertainty remains a factor, with traders positioning around interest-rate expectations and equity market volatility, but the appetite for digital assets has remained resilient.

Beyond price action, Filecoin continues to build community engagement. The protocol is set to host a Spaces discussion on artificial intelligence, signaling its intent to link decentralized storage with emerging technologies. While such developments may not directly drive near-term price, they contribute to long-term adoption narratives that reinforce investor confidence.

Outlook for Filecoin

With support confirmed in the $2.38–$2.39 zone and resistance defined at $2.46, Filecoin enters a critical phase of technical price discovery. The next sessions will test whether elevated volumes can sustain momentum beyond current thresholds. A successful break higher would bolster the view of institutional accumulation, while failure to breach resistance could shift focus back to consolidation ranges.

For crypto investors, Filecoin’s trajectory illustrates how mid-cap tokens can mirror broader market risk sentiment while carving out distinct technical narratives. With volume validating its latest rebound, the market will watch closely to see if FIL can extend its momentum beyond immediate resistance.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

https://shorturl.fm/iNdKG