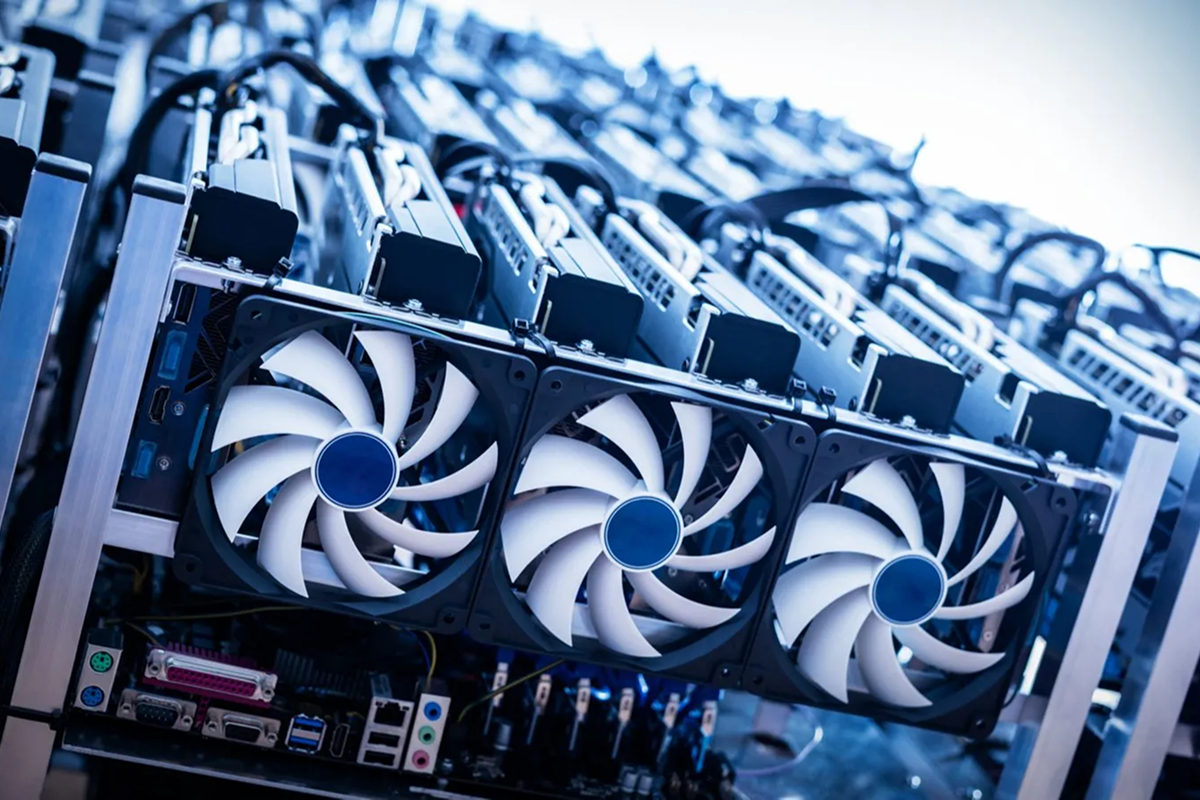

Bitcoin mining equities are sharply diverging in 2025, with IREN emerging as a top performer while Bitdeer Technologies struggles to keep pace amid higher costs and execution concerns. The split highlights how post-halving economics, power efficiency, and balance-sheet discipline are reshaping investor preferences across the crypto infrastructure landscape.

The contrast comes as Bitcoin trades in a volatile range, forcing miners to prove operational resilience rather than rely on price appreciation alone.

Market Performance and Equity Divergence

In 2025 year-to-date trading, IREN shares have climbed roughly 35%–40%, outperforming both the Bitcoin mining equity index and spot BTC, which is up closer to 10% over the same period. By contrast, Bitdeer stock is down approximately 15%–20%, lagging peers such as Marathon Digital and CleanSpark.

Trading volumes reinforce the divergence. IREN has seen average daily volume rise by more than 25% since the start of the year, suggesting growing institutional participation. Bitdeer’s volume, meanwhile, has remained flat, pointing to limited conviction among incremental buyers.

Operational Efficiency and Cost Structure

At the core of IREN’s outperformance is its focus on low-cost renewable energy and disciplined expansion. The company reports an all-in power cost below $0.035 per kWh, placing it among the most efficient large-scale miners globally. Hashrate capacity has expanded toward 20 EH/s, while maintaining a relatively conservative leverage profile.

Bitdeer, by comparison, continues to invest heavily in proprietary mining hardware and hosting infrastructure. While strategically ambitious, those investments have pressured margins, with estimated breakeven levels closer to $45,000–$50,000 per BTC, versus IREN’s sub-$35,000 range.

Investor Sentiment and Post-Halving Strategy

Following the 2024 Bitcoin halving, investors have become more selective, rewarding miners that can generate free cash flow at lower hash prices. Strategically, IREN is viewed as a “survivor trade,” benefiting from consolidation as weaker operators exit or dilute shareholders.

Bitdeer’s longer-dated bet on vertical integration has attracted skepticism in the near term. While some long-only funds view the stock as a potential turnaround candidate, hedge fund positioning suggests a preference for miners with immediate earnings visibility.

Looking ahead, the relative performance of mining stocks will hinge on Bitcoin price stability, network difficulty adjustments, and access to cheap power. For crypto-focused investors, the 2025 mining landscape underscores a shift from scale-at-all-costs toward efficiency-driven dominance, with IREN currently setting the benchmark.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

09betvip – gotta say, I like the VIP treatment. Feels a bit fancier around here. Not a bad spot to hang out. You can explore this at 09betvip.