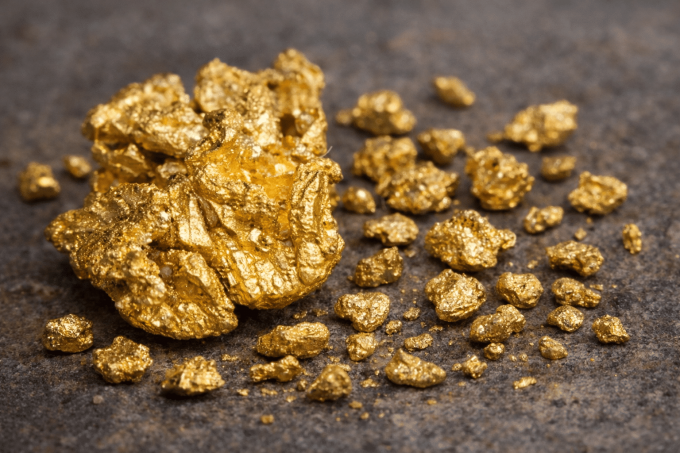

Gold Reserves Continue to Grow

El Salvador’s central bank has expanded its gold reserves with a $50 million purchase announced on Thursday, reinforcing the country’s diversification strategy amid global market volatility. The acquisition brings the central bank’s total gold holdings to more than $360 million, underscoring a renewed emphasis on hard assets alongside unconventional reserve policies.

The move comes as gold prices remain near historic highs, benefiting from strong demand driven by geopolitical risk, central bank buying, and declining confidence in fiat currencies.

Bitcoin Strategy Remains Intact

Alongside the gold purchase, El Salvador continued its steady accumulation of bitcoin. Data tracked by Arkham shows the government added one additional coin on Thursday, consistent with President Nayib Bukele’s long-standing commitment to buy one bitcoin per day.

The country’s bitcoin holdings now stand at 7,547 BTC, valued at approximately $635 million at current prices just above $84,000. El Salvador remains the only nation-state to hold bitcoin as part of its official treasury strategy.

Bukele Signals Confidence

President Bukele reposted the central bank’s announcement on social media with the comment, “We just bought the other dip.” The remark appeared to reference both the gold purchase and the continued bitcoin accumulation, reinforcing the administration’s confidence in alternative reserve assets during periods of market weakness.

Dual-Track Reserve Strategy

El Salvador’s approach highlights a dual-track reserve policy that combines traditional safe-haven assets with digital assets. While the central bank builds exposure to gold, the government continues to treat bitcoin as a long-term strategic holding rather than a short-term trade.

The parallel accumulation of gold and bitcoin positions El Salvador as a unique case study in sovereign reserve management, blending conventional monetary hedges with a high-conviction bet on digital assets as a future store of value.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Invite your network, boost your income—sign up for our affiliate program now!