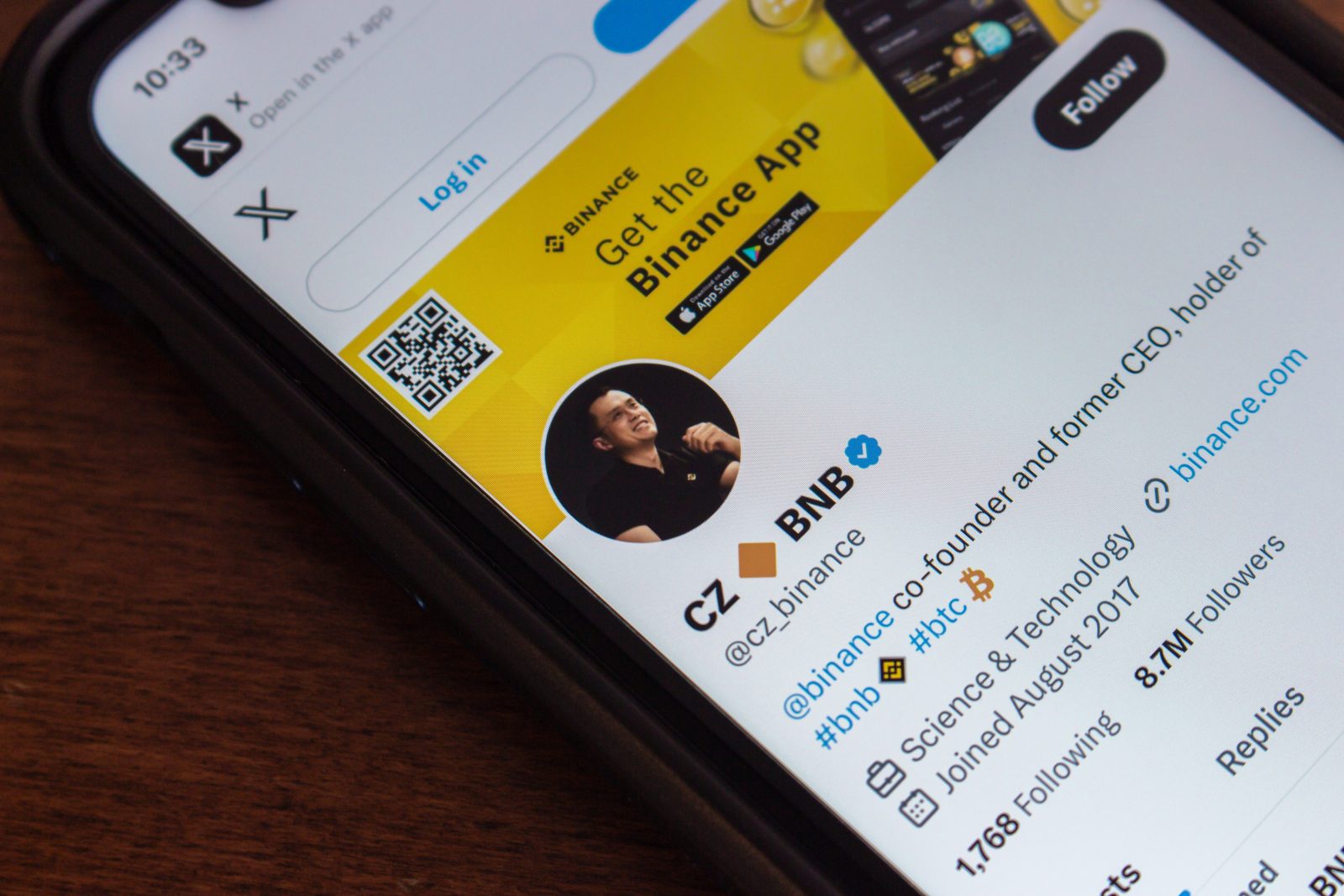

BNB Gains Ground on High Volume After Trump Pardons Binance Founder CZ

Binance Coin (BNB), the native token of the BNB Chain ecosystem, experienced a significant surge in trading volume and a modest price increase following the news that U.S. President Donald Trump had pardoned Binance founder and former CEO Changpeng Zhao (CZ). The pardon removes a significant cloud of uncertainty around one of the industry’s most influential figures and has been interpreted by some as a positive signal for Binance’s future, particularly regarding its access to the U.S. market.

Market Reacts to Presidential Pardon

BNB climbed 3.3% in the 24 hours following the announcement, reaching $1,126. While a moderate gain, the move was accompanied by a substantial spike in trading activity. Volume jumped nearly 35% above its seven-day average, suggesting heightened market interest. Analysts interpret this high-volume buying pressure as indicative of long-term accumulation rather than short-term speculative froth.

The pardon itself nullifies Zhao’s conviction from November 2023, where he pleaded guilty to violating the Bank Secrecy Act by failing to implement an effective anti-money laundering program at Binance. He served a four-month prison sentence earlier this year. The White House framed the original prosecution as part of the previous administration’s “war on cryptocurrency.”

Potential Turning Point for Binance?

Industry observers are viewing the pardon as potentially pivotal. “We believe CZ’s pardon is more than an inflection point for him personally, but also for BNB and potentially for Binance, paving the way for greater access to the US market,” commented David Namdar, CEO of CEA Industries, the largest publicly traded BNB treasury firm.8 He further emphasized BNB’s strong fundamentals, citing its “vast global user base, deep real-world adoption, and consistent utility across DeFi and CeFi alike.”

Technical Consolidation Underway

From a technical perspective, BNB appears to be consolidating after its initial reaction rally. The price surged from $1,085.96 to a high of $1,130.25 before encountering resistance in the $1,140–$1,143 zone. Since then, the token has established a tight trading range, finding support near $1,124 while facing resistance at $1,128.

Traders are now closely watching these levels. A sustained break above the immediate resistance could open the path toward the next significant target around $1,150. Conversely, a failure to hold the current support might lead to a retest of the lower levels near $1,078. The market’s ability to absorb the initial excitement and build a base above current support will be key in determining the sustainability of this pardon-driven momentum.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

https://shorturl.fm/ZXssr

https://shorturl.fm/ySdBH

https://shorturl.fm/B9mmI

https://shorturl.fm/PMEdu

https://shorturl.fm/V3ozm