Institutional Faith in Tokenization Deepens

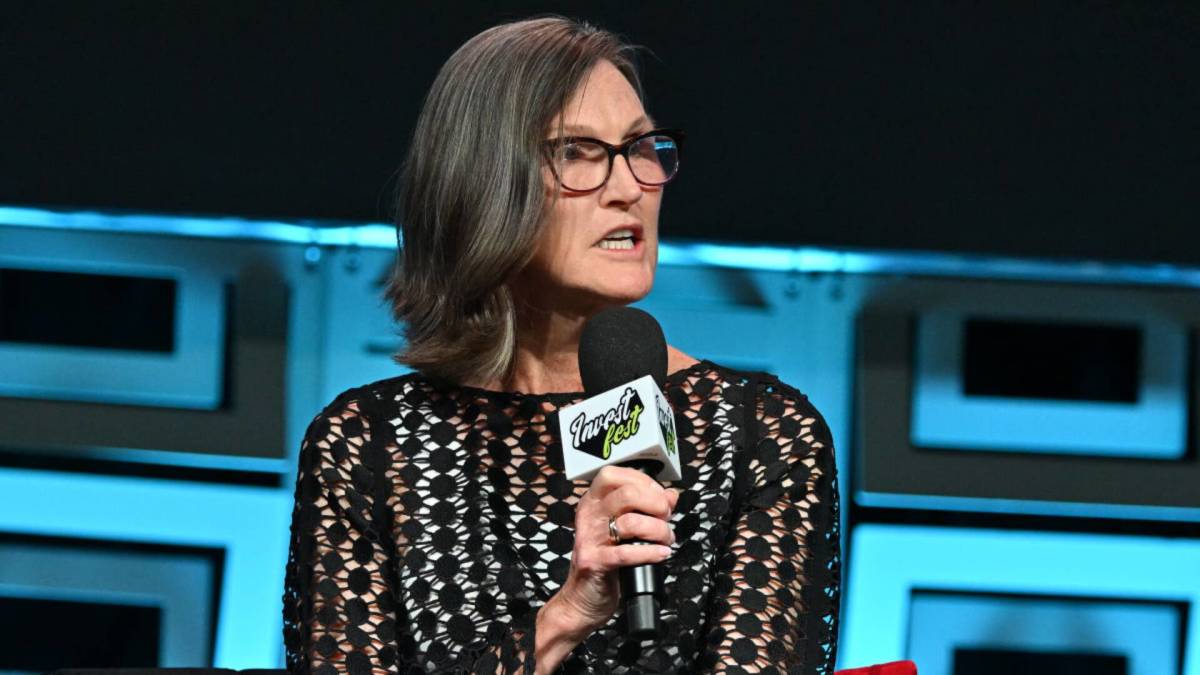

Cathie Wood’s ARK Invest is doubling down on blockchain’s integration with traditional finance, announcing a strategic investment in Securitize, a BlackRock-backed platform specializing in tokenized real-world assets (RWAs). The move comes amid rising global momentum toward on-chain finance, where assets like private equity, bonds, and funds are represented as blockchain tokens.

The investment reinforces ARK’s long-term thesis that tokenization could redefine capital markets by improving liquidity, transparency, and settlement speed — three pain points that continue to constrain traditional financial infrastructure.

A Growing Market Opportunity

The tokenization market is projected to exceed $16 trillion by 2030, according to Boston Consulting Group, representing a seismic shift in how capital is raised and traded. Securitize has already partnered with major asset managers including BlackRock and Hamilton Lane, offering compliant issuance and trading of tokenized securities under existing regulatory frameworks.

“Tokenization is not a concept anymore — it’s becoming operational,” said a senior Securitize executive. The firm’s platform is used to digitize assets such as private credit and real estate, lowering barriers for institutional investors and potentially retail participants as well.

ARK’s Strategic Perspective

For ARK, the investment marks another bet on the infrastructure layer of decentralized finance (DeFi). Rather than focusing on speculative crypto assets, Wood’s firm is targeting regulated blockchain applications that bridge institutional capital with decentralized rails.

ARK’s decision also aligns with BlackRock CEO Larry Fink’s recent statements describing tokenization as the “next generation for markets.” By supporting a platform that enables institutional-grade compliance, ARK positions itself at the nexus of financial innovation and regulatory adaptation.

Investor Sentiment and Market Psychology

Investor reaction has been broadly optimistic. Market analysts view ARK’s move as validation that tokenization is transitioning from narrative to execution. “Institutional alignment is key,” said one hedge fund strategist. “When both ARK and BlackRock support the same infrastructure play, the market listens.”

However, some observers caution that tokenized asset liquidity remains shallow compared to traditional exchanges. Execution risk — from technology adoption to regulatory harmonization — continues to shape how quickly tokenization can scale globally.

A Glimpse Into the Next Financial Era

As inflation eases and risk appetite improves, tokenized markets could attract fresh institutional flows seeking efficiency and transparency. If Securitize succeeds in integrating seamlessly with traditional asset management, it could mark a pivotal shift in how securities are issued, traded, and owned — bringing blockchain closer to the heart of global finance.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Leave a comment