AVAX One, a digital asset vehicle linked to Anthony Scaramucci, tumbled sharply after uncertainty emerged around potential shareholder sales, triggering a rapid reassessment of valuation and liquidity risk. The selloff unfolded against a fragile crypto backdrop marked by cautious risk appetite, tighter financial conditions, and heightened sensitivity to governance and disclosure issues across token-linked investment structures.

For institutional and professional investors, the episode underscores how ownership transparency and capital structure clarity can materially influence price stability in crypto-adjacent vehicles.

Market Reaction: Sharp Selloff on Heavy Volume

AVAX One fell approximately 32% over a short trading window, significantly underperforming both Avalanche (AVAX), which declined by around 4% over the same period, and the broader crypto market. Trading volumes surged to more than 2.5x the recent daily average, indicating forced selling and rapid position unwinds rather than gradual rebalancing.

Market participants cited uncertainty around whether early backers or affiliated shareholders might reduce exposure, increasing the perceived risk of near-term supply overhang. In thin or sentiment-driven markets, even the possibility of incremental selling can have an outsized impact on price discovery.

Structure and Governance: Why Shareholder Clarity Matters

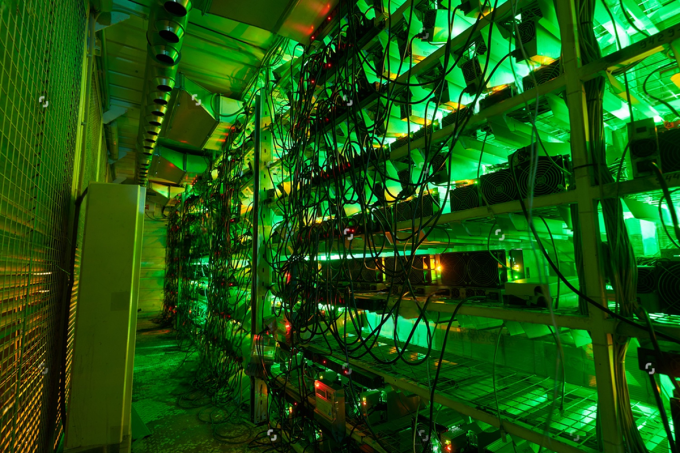

Unlike spot tokens, vehicles such as AVAX One often sit at the intersection of private capital, public market trading, and crypto-native assets. This hybrid structure can amplify volatility when disclosures around lock-ups, redemption rights, or secondary sales are unclear.

Analysts note that governance uncertainty has become a key valuation input, particularly after a series of high-profile crypto collapses reinforced the importance of who owns what—and when they can sell. Even absent confirmed transactions, ambiguity alone can trigger repricing as risk models adjust for worst-case scenarios.

Investor Sentiment: Reputation Risk and Reflexive Selling

From a behavioral standpoint, the selloff reflects a classic reflexivity loop. Concerns about shareholder sales weakened confidence, prompting early exits that further depressed prices and reinforced bearish sentiment. The association with a high-profile figure such as Scaramucci added a reputational dimension, intensifying scrutiny and accelerating reaction times among institutional desks.

Derivatives data showed a rise in short positioning and wider bid-ask spreads, suggesting liquidity providers demanded greater compensation for risk amid elevated uncertainty.

Looking ahead, investors will watch for clearer communication around shareholder intentions, updated disclosures on ownership concentration, and whether price stabilization attracts longer-term capital. More broadly, the episode serves as a reminder that in crypto-linked investment products, governance risk can be just as consequential as token fundamentals or network adoption metrics.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Leave a comment