Bitcoin mining stocks surged alongside broader AI-linked equities after reports that Anthropic, a leading artificial intelligence developer, is advancing a multibillion-dollar fundraising round that underscores sustained capital appetite for AI infrastructure. The move comes as crypto markets balance steady bitcoin prices, post-halving economics, and a macro backdrop shaped by easing inflation expectations and selective risk-on positioning across technology assets.

For crypto investors, the rally highlights the growing intersection between AI compute demand, energy-intensive infrastructure, and publicly listed bitcoin miners repositioning their business models beyond pure hash-rate exposure.

Market Reaction: Miners Outperform as AI Optimism Spills Over

Shares of major U.S.-listed bitcoin miners posted sharp gains, with several names rising between 8% and 15% in a single session, outperforming both bitcoin—which traded within a narrow 1–2% range—and the broader equity market. Trading volumes across leading miners were more than 40% above their 30-day averages, signaling renewed institutional participation.

The catalyst was not a direct crypto-specific headline, but rather renewed confidence that AI capital expenditure remains robust. Investors increasingly view miners with large-scale data centers and power contracts as optional beneficiaries of AI-related demand, particularly for high-performance computing and colocation services.

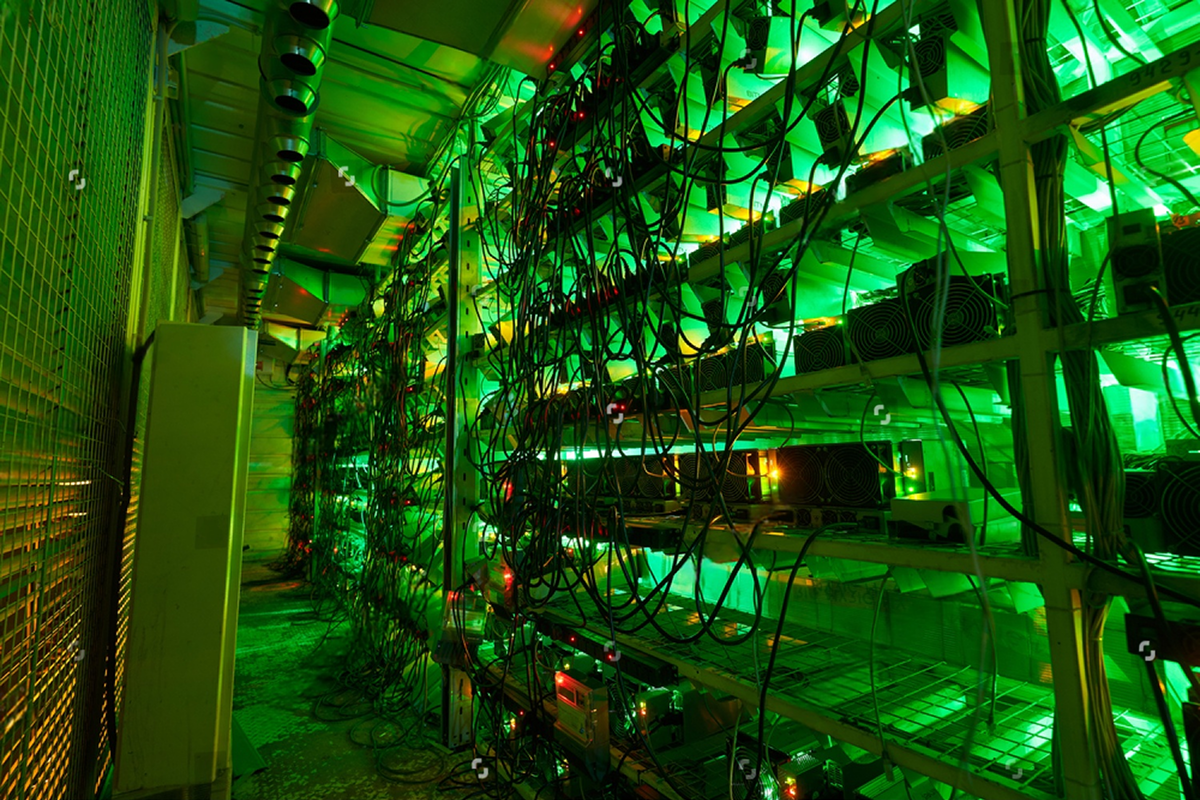

Technology and Infrastructure: From Hash Rate to Compute Capacity

The strategic narrative around miners has evolved materially since the bitcoin halving, which reduced block rewards by 50% and pressured margins. Several publicly traded miners now allocate a portion of capex toward AI and HPC workloads, leveraging existing energy infrastructure and land assets.

Industry disclosures show that non-mining compute initiatives still represent less than 10% of total revenue for most miners, but forward guidance suggests this share could rise meaningfully over the next 12–24 months. Anthropic’s reported fundraising—widely estimated in the $2–3 billion range—reinforces expectations that AI developers will continue competing aggressively for power-secure data centers.

Investor Sentiment: Convergence of Crypto and AI Trades

From a behavioral perspective, the rally reflects a convergence trade rather than a pure bitcoin bet. Portfolio managers appear increasingly willing to treat miners as a hybrid exposure spanning digital assets, energy, and AI infrastructure. This has reduced correlation with short-term bitcoin price moves, while increasing sensitivity to developments in technology funding and cloud-scale compute demand.

At the same time, implied volatility in miner equities remains elevated—often exceeding 70% on an annualized basis—highlighting that the market is still pricing significant execution and regulatory risk alongside growth optionality.

Looking ahead, investors will monitor whether AI-related revenue diversification can materially offset post-halving pressures, how quickly new compute contracts translate into cash flow, and whether sustained AI fundraising supports longer-term infrastructure demand. For crypto-focused portfolios, the episode underscores that bitcoin miners are increasingly influenced by forces well beyond the price of bitcoin alone.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Leave a comment