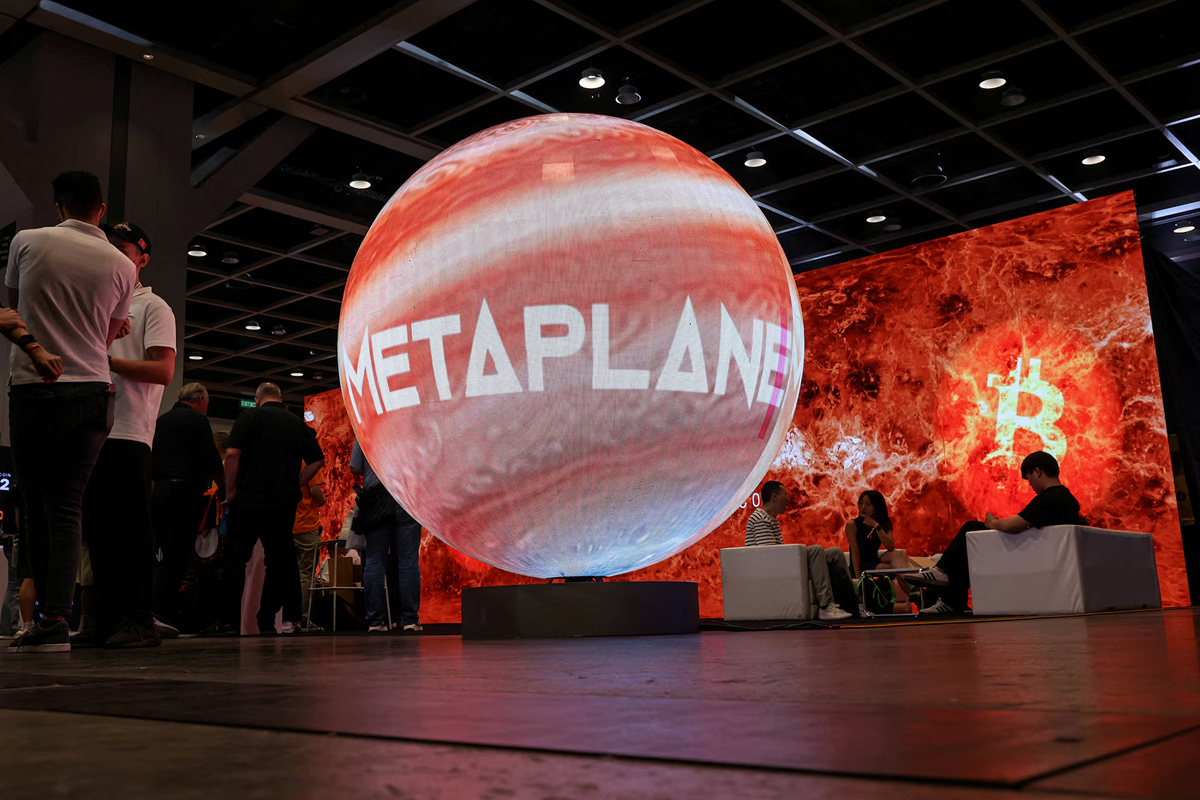

Metaplanet, the Tokyo-listed firm increasingly viewed as Asia’s answer to corporate Bitcoin treasuries, disclosed the purchase of an additional 4,279 BTC, bringing its total holdings to 35,102 bitcoin. The move comes amid subdued but resilient crypto markets, as institutional players continue to position for longer-term monetary and regulatory shifts.

The acquisition underscores how corporate balance sheets are becoming a meaningful source of structural demand for Bitcoin, even as short-term price action remains sensitive to macro policy and liquidity conditions.

Market Reaction and Supply Dynamics

At current prices near the $85,000–$90,000 range, Metaplanet’s latest purchase represents an investment valued at roughly $360–$385 million. With total holdings now exceeding 35,000 BTC, the firm ranks among the largest publicly disclosed corporate holders globally.

While the announcement did not trigger immediate volatility in Bitcoin’s spot price, analysts note that incremental corporate accumulation tightens liquid supply. On-chain data suggests that more than 70% of bitcoin has not moved in over six months, reinforcing the view that long-term holders continue to dominate market structure.

Strategic Rationale Behind Corporate Accumulation

Metaplanet has positioned Bitcoin as a core treasury reserve asset, citing its fixed supply of 21 million coins and long-term hedge characteristics against currency debasement. The strategy mirrors approaches adopted by other corporate treasuries, where bitcoin exposure is treated as a strategic allocation rather than a trading asset.

From a financial perspective, the firm’s accumulation strategy increases balance-sheet sensitivity to Bitcoin price movements, amplifying both upside potential and drawdown risk. For institutional observers, this reinforces how corporate adoption can reshape equity narratives alongside traditional crypto market cycles.

Regulatory and Regional Context

Metaplanet’s expansion comes as Japan’s regulatory framework for digital assets remains among the more developed in Asia. Clear custody, accounting, and disclosure standards have reduced operational uncertainty for listed companies holding crypto assets.

Regionally, Asia-based institutional participation has accelerated, with regulated exchanges and custodians reporting double-digit growth in institutional onboarding year over year. Analysts argue that regulatory clarity, rather than speculative enthusiasm, is increasingly driving capital allocation decisions.

Investor Sentiment and Market Signaling

From a behavioral standpoint, large, repeated purchases by corporate entities often serve as a confidence signal to long-term investors. While retail activity tends to respond to short-term price momentum, institutional and corporate buyers typically emphasize multi-year horizons.

Looking ahead, investors will watch whether Metaplanet continues to scale its Bitcoin exposure and how the market absorbs additional corporate demand amid evolving macro conditions. With supply growth constrained and institutional frameworks maturing, corporate treasury strategies are likely to remain a key variable shaping Bitcoin’s market structure in the years ahead.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Yo, pkr47game just caught my eye. Pretty straightforward platform with a few interesting twists. If you’re bored, give it a looksee. You might like what you see. More at pkr47game