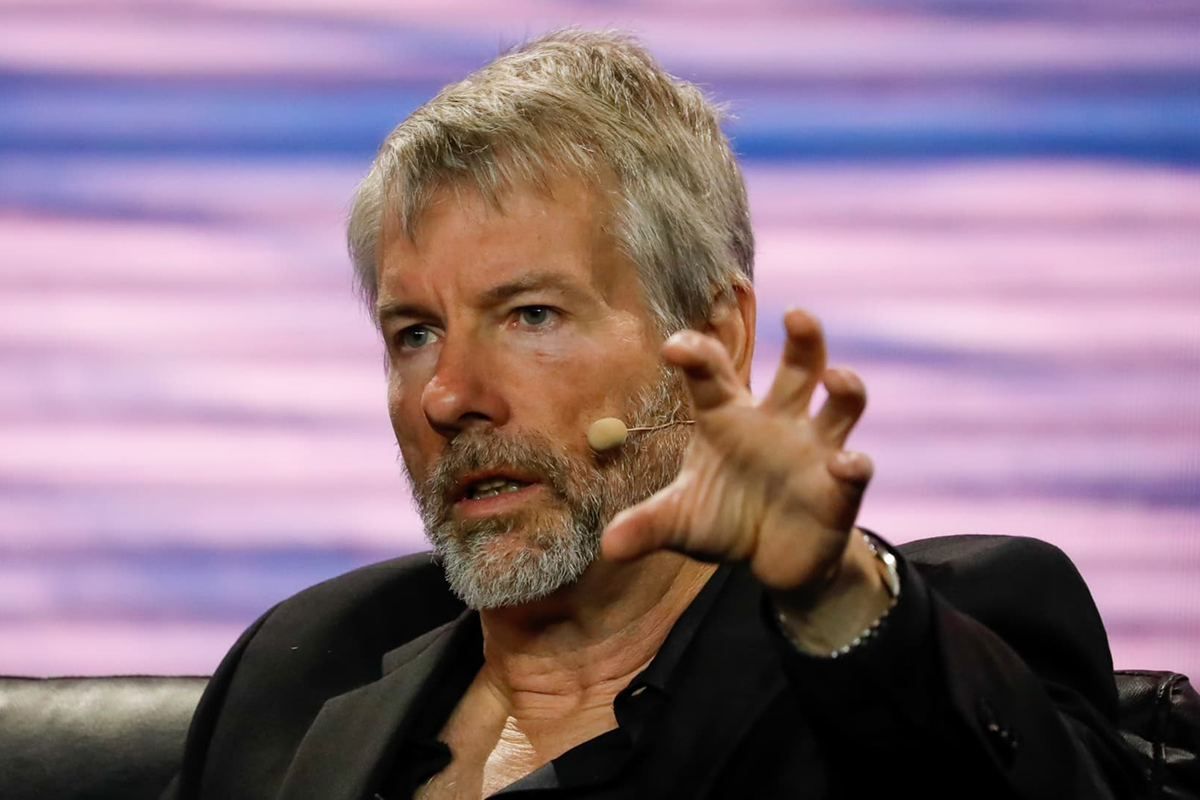

Michael Saylor, executive chairman of MicroStrategy, hinted at additional bitcoin purchases in a mid-week social media post, breaking from the company’s usual early-week communication pattern. The signal arrived as crypto markets trade cautiously amid tighter global financial conditions, renewed macro uncertainty, and sustained institutional scrutiny of digital assets.

While brief, the message was enough to reignite discussion around corporate bitcoin accumulation and its broader implications for market structure and investor psychology.

Market Reaction and Price Dynamics

Following Saylor’s post, bitcoin traded modestly higher, briefly reclaiming the $60,000 level before stabilizing, according to aggregated exchange data. Intraday volumes rose approximately 8% versus the prior 24-hour average, suggesting short-term speculative positioning rather than broad risk-on rotation.

Shares of MicroStrategy, which acts as a leveraged proxy for bitcoin exposure, also edged higher in U.S. trading, outperforming the Nasdaq Composite on the day. Historically, Saylor’s purchase signals have coincided with near-term volatility rather than sustained directional moves, underscoring the market’s sensitivity to narrative-driven catalysts.

Corporate Accumulation Strategy in Focus

MicroStrategy remains the world’s largest publicly listed corporate holder of bitcoin, with holdings exceeding 190,000 BTC based on its most recent disclosures. At current prices, that position represents tens of billions of dollars in notional exposure, financed through a mix of equity issuance and convertible debt.

Saylor’s indication of further buying suggests continued confidence in bitcoin as a long-duration treasury asset, even as regulators globally tighten disclosure standards around digital asset risk. For institutional investors, the strategy highlights an alternative model of balance-sheet management—one that diverges sharply from conventional cash or short-duration bond allocations.

Investor Sentiment and Behavioral Signals

From a behavioral perspective, Saylor’s messaging functions as a sentiment anchor for long-term bitcoin bulls. His consistency—both in market upswings and drawdowns—has cultivated a following that interprets each purchase as validation of bitcoin’s strategic thesis rather than a tactical trade.

However, professional investors tend to separate signaling from fundamentals. While Saylor’s actions can influence short-term flows, allocators increasingly focus on factors such as ETF inflows, real interest rates, and liquidity conditions. In this context, the post reinforces conviction among existing holders but is unlikely to materially shift institutional positioning on its own.

Strategically, the timing also matters. Mid-week communication disrupts established market rhythms, potentially amplifying attention in an otherwise low-catalyst session.

Looking ahead, investors will be watching for confirmation through formal disclosures, particularly whether additional purchases are funded via new capital market activity. As bitcoin continues to mature as an institutional asset, Saylor’s signals remain influential—but increasingly one input among many shaping market expectations.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Leave a comment