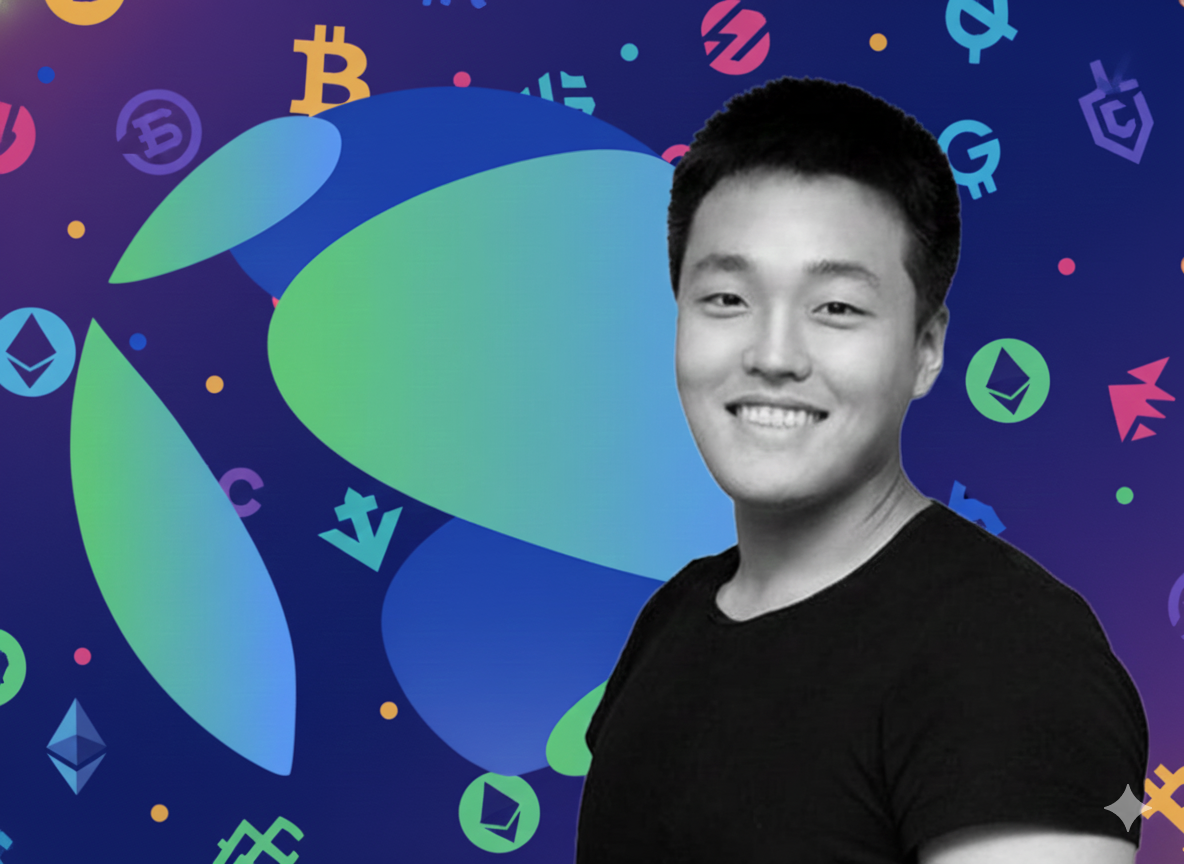

U.S. federal prosecutors have recommended a 12-year prison sentence for Do Kwon, the founder of Terraform Labs, whose collapsed crypto empire triggered one of the most devastating market failures in digital asset history. The request, filed Thursday in the Southern District of New York, follows Kwon’s guilty plea earlier this year in connection with defrauding investors and manipulating the crypto market through misleading claims about Terraform’s products.

Prosecutors Call Terraform Collapse One of the Worst in Crypto History

Kwon’s defense team petitioned for a five-year sentence, arguing that he has already served time in Montenegro and may still face prosecution in South Korea. U.S. prosecutors countered that the magnitude of the fraud demands a significantly longer term, describing the Terraform crash as unmatched in its economic damage.

According to the filing, investor losses stemming from the Terra-Luna implosion exceeded those associated with the collapses of FTX, Celsius, and OneCoin combined. Prosecutors emphasized that the fallout from Terraform’s destruction helped trigger the harsh downturn of 2022 — widely known as “crypto winter.”

They noted that Kwon fled jurisdiction, evaded authorities while issuing public denials, and resisted extradition once he was found. Those actions, prosecutors said, demonstrate a lack of accountability and justify a severe sentence that reflects both the gravity of the crimes and the need for deterrence in the crypto industry.

The Terra-Luna Crash and Its Market Impact

Terraform Labs grew into a multi-billion-dollar ecosystem centered on the algorithmic stablecoin UST, which attempted to maintain its $1 peg through an arbitrage mechanism with its sister token, LUNA. Unlike asset-backed stablecoins supported by U.S. Treasuries, UST relied entirely on code-driven balancing algorithms — a design that collapsed under market stress in May 2022.

At its peak, the Terraform ecosystem was valued at over $50 billion. The crash wiped out that value almost instantly, unleashing contagion across crypto markets, bankrupting trading firms and lenders, and sparking investigations worldwide.

Court filings revealed that Terraform’s stability was underpinned by hidden trading activity, undisclosed agreements, and misleading performance metrics — contradicting Kwon’s public assurances of decentralization and technological soundness.

Sentencing Ahead as Industry Watches Closely

Kwon’s sentencing is scheduled for December 11 in Manhattan federal court. The outcome will be closely watched as regulators and prosecutors continue to shape legal precedent around crypto fraud.

Given the scale of the Terra disaster — and the prosecutors’ comparison to other historic crypto collapses — the case may become a landmark in how the U.S. justice system handles misconduct in digital asset markets.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

https://shorturl.fm/pOjQs

Apaldologin makes it super easy to jump into the games. The site is clean and runs smoothly. Definitely worth checking out if you’re looking for a new spot to play. Login now at apaldologin.