Senior US financial regulators struck an unusually constructive tone on crypto adoption, with the SEC chair saying the “time is right” for pension funds to consider digital assets, while the CFTC head said the sector is positioned to flourish. The comments come as crypto markets stabilize after months of volatility and as institutional frameworks mature alongside tighter, clearer regulation.

For investors, the statements reinforce a broader narrative shift: crypto is increasingly being discussed not as a fringe asset, but as part of the long-term capital markets conversation.

Market Reaction and Institutional Signals

Following the remarks, Bitcoin and Ethereum traded modestly higher, with BTC holding near key technical levels and ETH outperforming several large-cap altcoins. Spot trading volumes across major exchanges rose by roughly 5%–7% intraday, according to aggregated market data, suggesting measured but positive institutional interest rather than speculative euphoria.

Publicly listed crypto-linked equities and infrastructure providers also saw incremental gains, reflecting investor sensitivity to regulatory tone. While price moves were contained, derivatives markets showed a slight uptick in open interest, indicating that professional traders were positioning for longer-term implications rather than short-term momentum.

Regulatory Implications for Pension Capital

The SEC chair’s comments are notable given the scale of the opportunity. US pension funds collectively manage more than $40 trillion in assets, yet current crypto exposure remains well below 1%. Even marginal allocation changes could materially impact liquidity, market depth, and volatility profiles.

Importantly, the remarks did not signal deregulation. Instead, they emphasized that clearer rules, improved custody standards, and regulated market infrastructure now make crypto a more assessable risk for fiduciaries. In parallel, the CFTC has continued to frame digital assets—particularly bitcoin and ether—as commodities that benefit from transparent derivatives markets and established risk management tools.

Investor Sentiment and Strategic Positioning

For institutional allocators, regulatory endorsement—however cautious—reduces career risk. Pension managers are historically slow-moving, but validation from both the SEC and CFTC shifts the internal conversation from “if” to “how.” This often leads first to indirect exposure via ETFs, futures, or infrastructure plays before any direct token holdings.

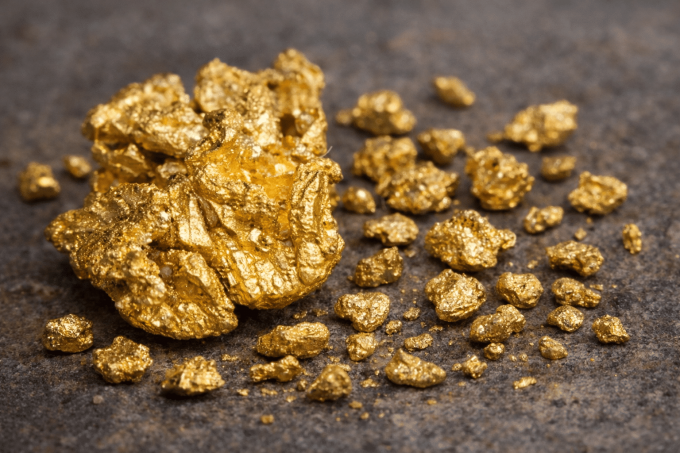

Behaviorally, markets tend to underreact to these inflection points in the short term. The larger impact often unfolds over quarters as policy statements translate into investment committee approvals, consultant frameworks, and revised asset allocation models. Crypto’s correlation with macro assets such as equities and gold will remain a key consideration, particularly in a higher-for-longer rate environment.

Looking ahead, investors will watch for follow-through: formal guidance on fiduciary standards, additional approvals for regulated products, and clearer jurisdictional boundaries between agencies. If rhetoric continues to align with policy execution, the pathway for pension capital into digital assets could gradually widen—reshaping crypto market structure more through patience than price spikes.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

Partner with us and enjoy high payouts—apply now!