Key Highlights:

-

The U.S. government moved to dismiss criminal charges against Roger Ver following a $49.9 million settlement with the IRS.

-

Ver admitted to underreporting his Bitcoin holdings prior to renouncing U.S. citizenship in 2014.

-

Despite the pending dismissal, prediction markets still price a 17–19% chance of a Trump pardon.

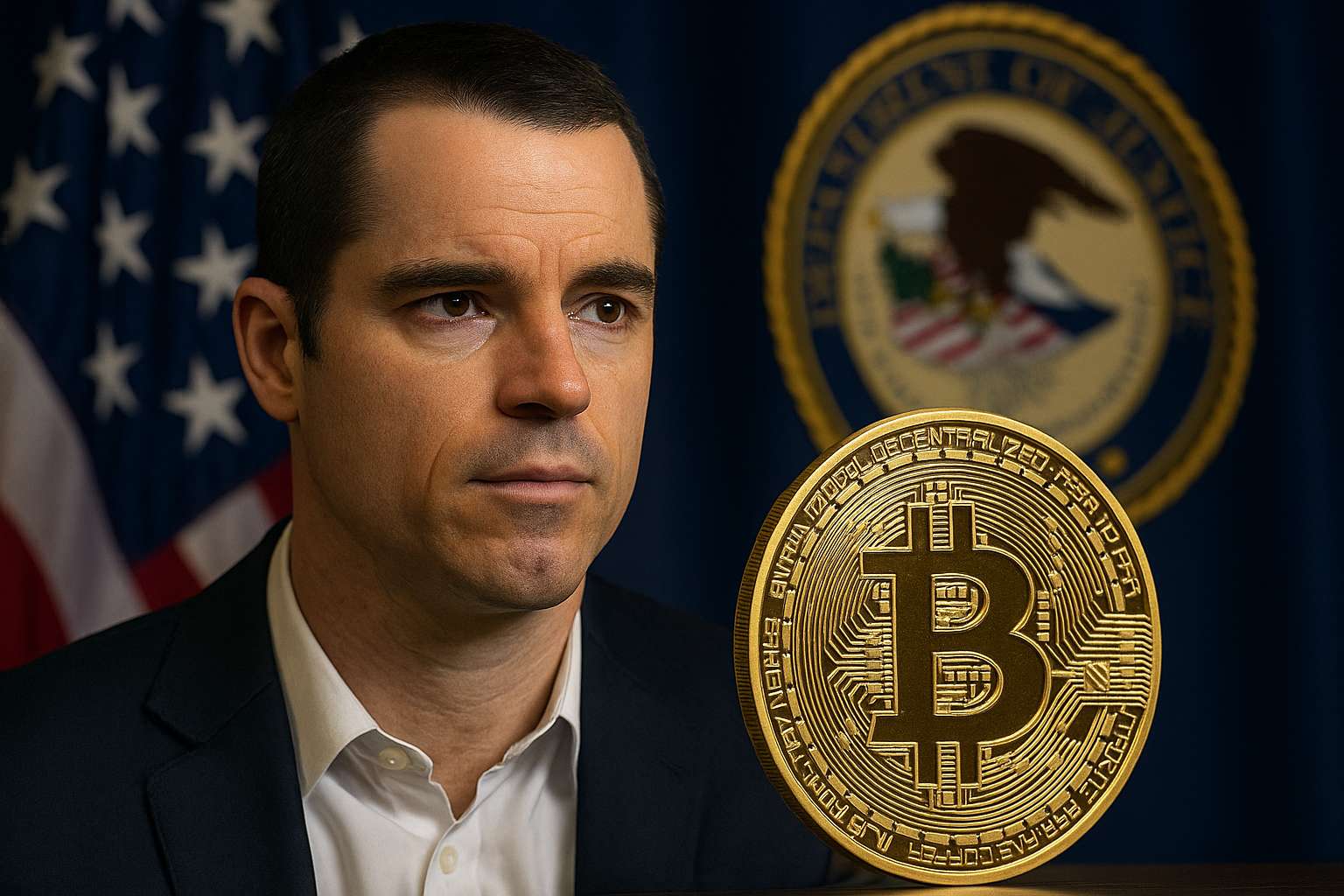

U.S. Government Moves to End High-Profile Crypto Tax Case

A long-running tax dispute between the U.S. government and early Bitcoin investor Roger Ver, known as “Bitcoin Jesus,” appears close to resolution after prosecutors moved to dismiss his criminal indictment in exchange for a $49.9 million settlement.

In a Tuesday filing with the U.S. District Court for the Central District of California, prosecutors requested Judge Michael Fitzgerald approve an order dismissing the case without prejudice, marking a significant development in one of the most closely watched legal battles involving a prominent crypto figure.

According to the filing, the U.S. government agreed to drop charges after Ver paid all tax, penalties, and interest owed to the Internal Revenue Service (IRS) stemming from his Bitcoin holdings. The case centered on allegations that Ver had underreported roughly 131,000 BTC — valued at about $74 million in 2014 — before renouncing his U.S. citizenship and relocating to St. Kitts and Nevis.

From “Bitcoin Jesus” to Legal Target

Roger Ver, one of Bitcoin’s earliest and most vocal advocates, earned the moniker “Bitcoin Jesus” for evangelizing cryptocurrency adoption long before it went mainstream. He became an influential figure in the crypto ecosystem, later supporting Bitcoin Cash (BCH) following the 2017 hard fork.

However, his global reputation took a turn in April 2024, when the U.S. Department of Justice (DOJ) indicted him for tax evasion and filing false returns. Prosecutors alleged that Ver used his expatriation and offshore holdings to avoid millions in U.S. taxes.

“[As] defendant admitted, when he filed his returns in May 2016, they did not report ownership of all these bitcoins and did not report capital gains from the constructive sale of all of these bitcoins,” the motion noted. The U.S. claimed the omissions cost the government $16.9 million in losses.

The proposed dismissal follows a deferred prosecution agreement (DPA) submitted in September, outlining the conditions for Ver’s case to be dropped. Under the DPA, Ver acknowledged his obligations to the IRS and agreed to full repayment.

Market Reaction and Community Response

Crypto market observers have reacted to the development with a mix of relief and skepticism. While many view the settlement as a sign of regulatory pragmatism, others see it as a reminder that crypto’s early pioneers remain under scrutiny.

Legal analysts note that the “without prejudice” clause means prosecutors could reopen the case if Ver fails to meet any payment or disclosure terms. However, given that both sides appear satisfied, most expect the matter to close permanently.

Ver’s public image remains polarizing within the digital asset community. Supporters argue he was targeted for his anti-establishment stance and early challenges to centralized financial systems. Critics counter that his actions reflect a broader need for compliance and transparency among crypto elites.

Political Speculation and a Possible Trump Pardon

Even as the legal process winds down, speculation around a potential presidential pardon continues to fuel online debate. On Polymarket and Kalshi, prediction platforms popular with crypto traders, bettors currently assign 17% and 19% odds, respectively, that Donald Trump will grant Ver a pardon, commutation, or reprieve before December 31, 2025.

Ver himself has played into that speculation. In January, he publicly appealed to Trump on social media, describing his prosecution as an act of “lawfare” and urging the former president to intervene.

Whether or not a pardon materializes, Ver’s settlement may mark the end of one of crypto’s most visible legal sagas — and a cautionary tale for early adopters navigating the intersection of digital wealth and traditional tax systems.

As the industry matures and governments tighten oversight, the Ver case underscores a broader reality: crypto’s early decentralization ethos is colliding with the full force of institutional regulation — and even its oldest disciples are no longer exempt.

Comparison, examination, and analysis between investment houses

Leave your details, and an expert from our team will get back to you as soon as possible

https://shorturl.fm/hkcg9

https://shorturl.fm/j8861