Bitcoin Mining Difficulty Hits New Record, Squeezing Miner Profitability and Fueling Centralization Debate

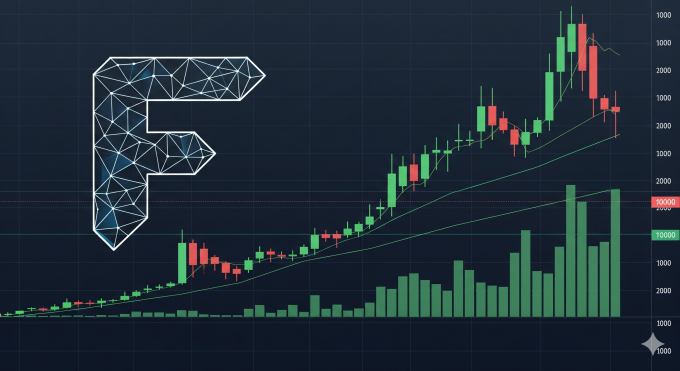

The Bitcoin network’s mining difficulty has surged to a new all-time high of 134.7 trillion, signaling unprecedented competition among miners to secure the blockchain. This record, set on Friday, underscores the network’s growing security and robustness, but it also intensifies the economic pressures on mining operations and adds fuel to the ongoing debate about network centralization.

Unpacking the Metrics: Difficulty vs. Hash Rate

Mining difficulty is a self-adjusting metric designed to ensure that a new block is added to the Bitcoin blockchain approximately every ten minutes, regardless of how much computing power is dedicated to the network. The new record was reached even as the network’s total hash rate—a measure of that computing power—has slightly receded to 967 billion hashes per second from its own all-time high of over 1 trillion set in August.

The sustained rise in difficulty, despite this minor hash rate pullback, indicates that a massive amount of computational power remains committed to the network. This forces miners to expend ever-greater resources to compete for the block reward, which currently stands at 3.125 BTC (valued at over $344,000).

Economic Implications for the Mining Industry

For the mining industry, which operates on notoriously thin profit margins, a higher difficulty level directly translates to increased operational costs per bitcoin mined. This dynamic creates a relentless “arms race,” favoring large-scale, well-capitalized mining firms that can leverage economies of scale and access the latest, most efficient hardware.

This trend has amplified concerns about the centralization of Bitcoin mining. As the cost and complexity of a viable mining operation increase, it becomes progressively harder for smaller entities to compete, potentially concentrating control over the network’s security in the hands of a few major corporations and mining pools.

The Resilience of the Solo Miner

Despite the industrial-scale nature of modern mining, the network’s probabilistic design still allows for rare but significant exceptions. In July and August, three different solo miners, operating through the Solo CK mining pool, each defied the odds to successfully mine a block. These individual successes, each netting a full block reward, serve as a potent reminder that while large players dominate, the opportunity to participate in securing the network is not entirely closed off to smaller operations.

The new difficulty record paints a picture of a healthy, secure, and highly competitive network. However, this strength is forcing a rapid maturation of the mining sector, where efficiency and scale are paramount. The ongoing tension between this industrialization and the core principle of decentralization will remain a central theme for the industry moving forward.

https://shorturl.fm/vj9xn