Key Points:

-

Arthur Hayes sees ongoing U.S. and global monetary expansion driving crypto market momentum through 2026.

-

Bitcoin and other major digital assets are poised to benefit from liquidity tailwinds, despite short-term volatility.

-

Investor sentiment may increasingly favor risk-on positioning as central banks continue accommodative policies.

Monetary Policy as a Crypto Catalyst

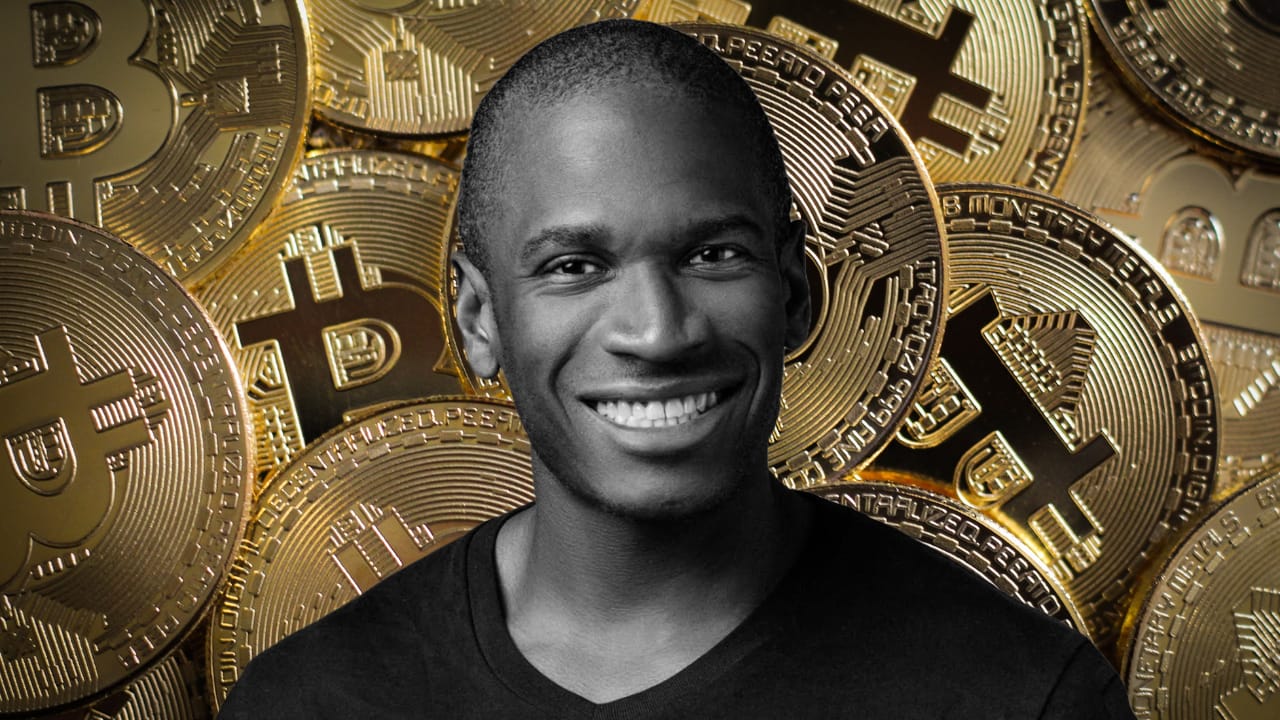

Arthur Hayes, co-founder of crypto derivatives giant BitMEX, has forecast that continued money printing by global central banks will extend the current cryptocurrency market cycle well into 2026. Speaking in a recent interview, Hayes emphasized that loose monetary conditions provide a structural tailwind for risk assets, including Bitcoin (BTC) and Ether (ETH), which have both seen year-to-date gains of roughly 23% and 18%, respectively.

Hayes’ comments come amid a backdrop of sustained liquidity injections, with U.S. M2 money supply expanding by 5.2% year-to-date, despite recent Federal Reserve signals of tightening. He argued that the combination of high savings, ongoing quantitative easing in some jurisdictions, and investor appetite for alternative assets sets the stage for an extended bull market in digital currencies.

Crypto Markets and Liquidity Dynamics

Bitcoin currently trades around $116,500, hovering near multi-year highs, while futures and options data indicate that investors are positioning for further gains. Hayes highlighted that the futures curve remains in contango, suggesting sustained optimism and willingness to pay premiums for longer-dated contracts.

“Liquidity drives cycles,” Hayes explained. “As long as money is being printed and interest rates remain historically low, capital will seek asymmetric returns in markets like crypto.”

Analysts note that institutional inflows have accelerated in 2025, with U.S. spot Bitcoin ETFs attracting over $2.8 billion in net inflows since early September. These flows, coupled with retail enthusiasm, support Hayes’ view that the cycle may be prolonged.

Regulation and Investor Sentiment

Hayes also pointed to regulatory clarity as a factor bolstering investor confidence. The passage of stablecoin legislation under the GENIUS Act and ongoing discussions around a broader crypto market framework signal increasing acceptance of digital assets in the financial ecosystem.

Investor behavior, Hayes suggested, has shifted from short-term speculation toward strategic positioning for multi-year gains, reflecting a growing understanding of Bitcoin’s scarcity narrative and macroeconomic hedging potential. According to Cointelegraph Markets Pro data, BTC trading volumes have steadily climbed, suggesting heightened engagement from both retail and institutional participants.

Risks and Strategic Implications

Despite the bullish outlook, Hayes acknowledged risks: sudden interest rate hikes, regulatory interventions, or sharp liquidity shocks could temper crypto appreciation. He recommended that investors maintain flexible capital allocation strategies, using derivatives and spot exposure to manage risk amid potential volatility.

Market participants are also watching for macro catalysts, including U.S. inflation data and central bank policy meetings, which could prompt short-term corrections even as the longer-term cycle extends. Hayes believes that these fluctuations present opportunity windows rather than signals of a trend reversal.

Looking Forward

Hayes’ perspective underscores a broader narrative in the crypto market: digital assets are increasingly influenced by macroeconomic forces such as monetary expansion, liquidity flows, and regulatory certainty. While volatility remains an intrinsic feature of crypto markets, the ongoing accommodative stance of major central banks could provide tailwinds for Bitcoin and related assets through 2026.

Investors and institutions may therefore treat the current market phase as a strategic accumulation period, with an eye toward capturing upside while hedging against episodic pullbacks.

https://shorturl.fm/BmDFx

https://shorturl.fm/v8YZo