Dogecoin Targets $0.22 Breakout as Volume Surges on Institutional Catalysts

Dogecoin () is showing signs of renewed strength, with a significant surge in trading volume and resilient price action pointing to building bullish momentum. As the market digests a wave of institutional-focused news, traders are closely watching the critical $0.22 resistance level as the key threshold that could unlock the next major leg up for the original meme coin.

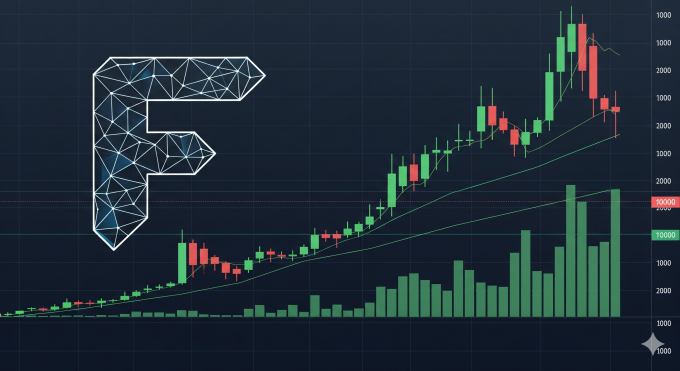

Technical Picture: Consolidation Meets Volume

Over the September 5–6 trading period, Dogecoin exhibited strong signs of accumulation. While its price saw a modest gain of nearly 1%, trading volume jumped 29% above its weekly average, indicating a high level of market interest. Price action was defined by a tight 3.6% range between a firm support base at $0.213 and a ceiling near $0.221.

A midday selloff on September 6 saw the price dip to $0.213, but the move was met with 1.31 billion in volume as buyers quickly stepped in, validating the strength of this support zone. Meanwhile, key indicators remain constructive. The Relative Strength Index (RSI) is holding in the neutral-to-bullish mid-50s, suggesting strength without being overbought, while the MACD histogram is converging toward a potential bullish crossover.

Institutional and ETF Catalysts Emerge

The elevated trading activity is not occurring in a vacuum. It is directly correlated with several significant off-chain developments that are reshaping Dogecoin’s investment narrative. Reports of a $200 million Dogecoin treasury initiative, reportedly led by Elon Musk’s legal counsel, have bolstered its institutional credibility.

Furthermore, the recent U.S. filings for the first spot Dogecoin ETFs by REX Shares and Osprey Funds have fueled speculative interest, with decisions anticipated in October. This institutional positioning is reflected in derivatives markets, where futures activity surged by 119% in August, signaling that larger players are actively placing bets on the asset’s future direction.

The Path Forward

Dogecoin is currently at a critical inflection point. The market has established a clear battleground: robust support at the $0.213–$0.214 level and formidable resistance at $0.22. A sustained close above this $0.22 ceiling is widely viewed by technical analysts as the primary trigger for a potential extended rally, with initial upside targets projected in the $0.30–$0.35 range. Failure to breach this level would likely keep DOGE within its current consolidation band, risking a retest of its well-defended support.

https://shorturl.fm/INqvq