French hardware wallet manufacturer Ledger is weighing a potential New York public listing as it benefits from a market-wide “flight to security.” The company confirmed its revenues have soared into the “triple-digit millions” in 2025, a boom driven by a record-breaking year for cryptocurrency hacks that has pushed both retail and institutional investors toward its “cold storage” solutions.

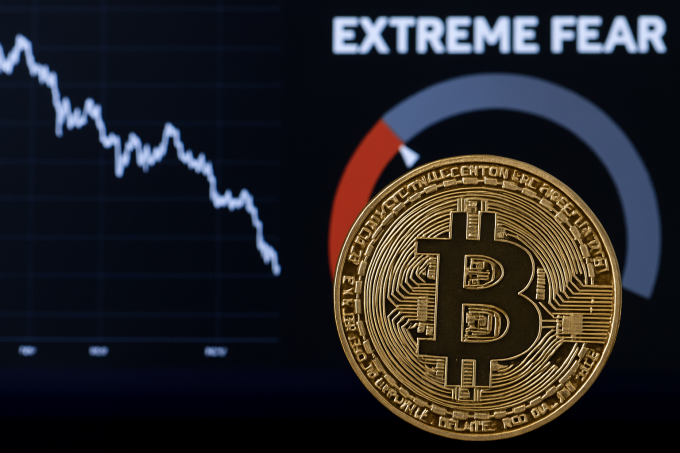

A Market Driven by Fear

Ledger’s surging revenue is a direct reflection of a deteriorating security environment for digital asset holders. According to a report from Chainalysis, hackers stole $2.2 billion worth of cryptocurrency in the first half of 2025 alone, a figure that has already surpassed the total for all of 2024. Critically, approximately 23% of these attacks targeted individual wallets, spooking retail investors and driving them away from “hot wallets” connected to the internet.

“We’re being hacked more and more every day… it’s not going to get better next year and the year after that,” Ledger CEO Pascal Gauthier told the Financial Times. This pervasive fear has become Ledger’s primary growth catalyst. The company, which now secures an estimated $100 billion worth of Bitcoin ($BTC$), is also anticipating further seasonal sales spikes from Black Friday and Christmas.

Pivoting to Wall Street

To capitalize on this momentum, Ledger is preparing to raise a new round of funding in 2026, with options including another private placement or a full U.S. public listing. Gauthier was unambiguous about the company’s strategic focus, noting its expanding New York headcount. “Money is in New York today for crypto, it’s nowhere else in the world, it’s certainly not in Europe,” he stated.

A New York listing would provide a major test of public market appetite for a crypto-native security firm. Ledger was last privately valued at $1.5 billion in a 2023 round backed by firms like 10T Holdings and True Global Ventures.

Growth Creates Friction

This push toward a more corporate, revenue-focused identity is not without its challenges. The company recently faced a backlash from its core community after launching a new multisignature (multisig) application. While the technology was praised, the new fee structure—including a $10 flat fee per transaction and a 0.05% variable fee—triggered criticism. Developers and long-time users accused the company of straying from its “Cypherpunk roots” and turning its app into a centralized “choke point” designed to “extract revenue.”

Ledger now finds itself navigating a critical transition. It has successfully translated widespread market fear into a balance sheet strong enough to warrant Wall Street’s attention. As it pivots from its Parisian origins toward a potential New York debut, the company must balance the demands of public market investors with the decentralized ethos of the very community that made its growth possible.

https://shorturl.fm/h4GLd

https://shorturl.fm/3h83L