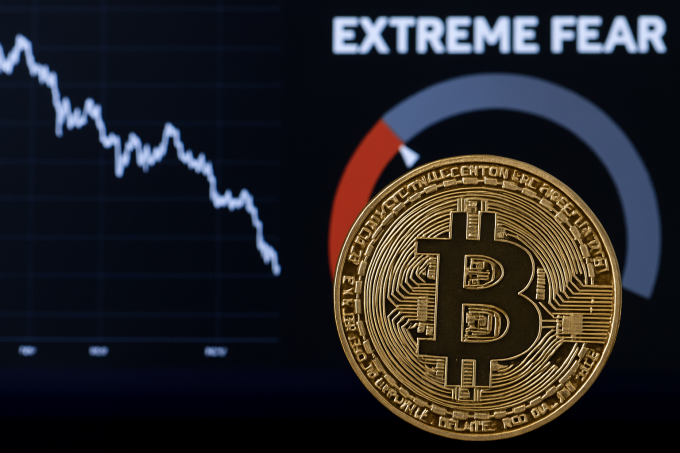

The latest session saw a broad retreat across risk assets, with major cryptocurrencies and U.S. tech stocks both coming under pressure as macro-liquidity worries intensify. This shift underscores how tightening monetary and fiscal conditions are increasingly weighing on the global crypto market.

Market Reaction

Within the past 24 hours, the Bitcoin price dropped to around $100,336, while the Nasdaq-100 index slid approximately 2.0–3.4 % this week, highlighting synchronized risk-off moves across crypto and equities. Analysts at Citi flagged Bitcoin’s breach of its 55-day moving average as an early warning signal for fading risk-appetite in equities, reinforcing the idea that crypto remains tightly coupled with broader speculative flows. Additionally, tightening liquidity has weighed on market breadth: U.S. bank reserves are estimated to have fallen by around $500 billion since July, directly reducing the pool of funds available for risk assets. For crypto investors this means that the near-term price action is less about digital-asset fundamentals and more about macro flow dynamics — the fade in leverage and risk-appetite is manifesting quickly.

Regulatory and Structural Implications

This risk-asset retreat occurs against a backdrop of structural constraints on liquidity and regulatory uncertainty. Elevated valuations in tech equities — such as the forward P/E for the S&P 500 reaching 23.1x, up from its five-year average of 19.9x — are prompting investors to reduce exposure. In crypto, the recent decline has seen significant deleveraging: one analysis notes that over $125 billion of leverage has been liquidated so far this year, limiting the capacity for ample speculative rebounds. From a structural perspective for institutions and allocators, the message is clear: regulatory and liquidity risks are rising, making crypto exposure more contingent on macro-backdrop robustness rather than just digital-asset thesis execution.

Investor Sentiment & Strategic Perspective

Investor psychology appears to be shifting. As speculative flows retract, traders are more focused on downside protection than upside chasing: in the crypto options market, positioning for Ethereum remains anchored in the $3,000–$3,400 range rather than elevated strike levels, indicating limited conviction in a near-term rally. This mindset aligns with a broader “risk-off” tilt: the fading allure of high-valuation sectors and leveraged strategies suggests investors are reallocating toward defensive or regulated exposures. For sophisticated crypto investors, this suggests a tactical shift may still be underway — from accumulation or momentum chasing toward hedging and recalibration.

Looking ahead, the prevailing backdrop signals that digital-asset markets are vulnerable to any further liquidity squeeze, regulatory surprise or macro shock. On the opportunity side, a sustained pivot back to risk assets would likely be a strong tailwind for crypto — but until that occurs, many allocators may wait on the sidelines or refine hedging strategies accordingly.

https://shorturl.fm/PhxCr