Key Points:

-

The U.S. government shutdown has entered its 38th day, paralyzing most federal operations and delaying action on key financial and crypto legislation.

-

The Senate is expected to vote on a continuing resolution Friday to temporarily reopen the government, but its passage remains uncertain.

-

The shutdown has effectively paused progress on the CLARITY Act — the major digital asset market structure bill that aims to define crypto regulation in the United States.

The U.S. government shutdown entered its 38th day on Friday, extending one of the longest interruptions in federal operations in modern history and leaving cryptocurrency legislation — including the much-anticipated CLARITY Act — in political limbo.

According to the U.S. Senate’s official calendar, lawmakers are set to vote on a continuing resolution (CR) passed by the House of Representatives earlier this week, which would temporarily fund the government and restore essential operations. However, it remains unclear whether the measure can achieve the 60-vote threshold needed to advance in the Senate.

Multiple prior attempts to resolve the funding impasse have failed, as deep partisan divisions persist over budget priorities — leaving crypto regulation and other legislative efforts sidelined.

Crypto Policy Stalled Amid Political Gridlock

The ongoing shutdown has forced the digital asset policy agenda into a standstill, even as industry leaders and investors watch closely for signs of progress on the CLARITY Act — a comprehensive crypto market structure bill that passed the House of Representatives in July with strong bipartisan support.

The bill, designed to clarify the division of oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), is widely seen as the most important piece of crypto legislation in U.S. history.

Its Senate counterpart, the Responsible Financial Innovation Act, co-sponsored by Senators Cynthia Lummis (R-Wyo.) and Kirsten Gillibrand (D-N.Y.), has also been stalled as congressional attention remains fixed on government funding and economic stability.

“The shutdown has frozen nearly every meaningful policy discussion in Washington, including crypto regulation,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “Until the government reopens, the CLARITY Act and related digital asset bills are effectively on ice.”

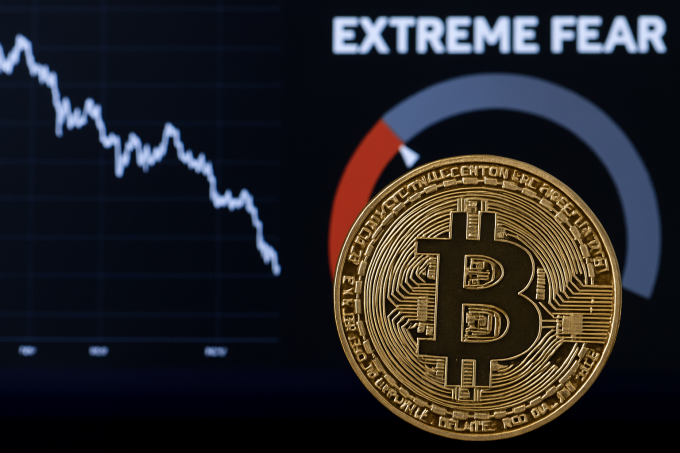

Crypto Industry Caught in Uncertainty

For the U.S. crypto industry, which has spent years pushing for a coherent regulatory framework, the shutdown represents yet another delay at a critical juncture.

With the CLARITY Act on hold, agencies like the SEC and CFTC remain under restricted operations, slowing review processes for crypto-related filings — including exchange-traded fund (ETF) applications, stablecoin proposals, and banking partnerships.

“This political paralysis undermines confidence in the U.S. as a hub for digital asset innovation,” said Hailey Lennon, partner at Brown Rudnick and former Coinbase counsel. “Other jurisdictions — from Europe to Singapore — are moving full speed ahead with comprehensive frameworks, while we’re stuck debating how to keep the lights on.”

The U.S. regulatory stalemate has already prompted several companies to look abroad. Exchanges and custodians have ramped up expansion in Europe, where the Markets in Crypto-Assets (MiCA) framework is being fully implemented in 2025. Meanwhile, the U.K. and Canada have both announced their own stablecoin and digital asset regulatory regimes, leaving the U.S. trailing.

Senate Divisions Deepen Over Budget Priorities

As of Friday morning, Senate leaders continued to negotiate terms of the continuing resolution. Democrats have demanded provisions to extend healthcare subsidies and reverse cuts introduced in the July funding bill, while Republicans seek broader spending reductions and new oversight measures.

Although members of Congress continue to receive paychecks during the shutdown, tens of thousands of federal employees have been furloughed or are working without pay, amplifying public frustration.

Political analysts say that while a temporary funding measure could be approved to reopen the government for several weeks, longer-term stability — and any chance of progress on crypto legislation — will depend on bipartisan compromise.

A Delicate Moment for Crypto Policy

Even if the government reopens, the timeline for advancing the CLARITY Act remains uncertain. Lawmakers face a crowded agenda — from budget negotiations to foreign policy — and crypto may struggle to regain immediate attention.

Still, advocates remain hopeful that 2025’s growing legislative momentum will not be lost. “The bipartisan foundation for digital asset policy is already there,” said Kristin Smith, CEO of the Blockchain Association. “The question is when Congress will have the bandwidth to act on it.”

Until then, the U.S. digital asset industry remains in regulatory limbo, waiting for Washington to get back to work.

https://shorturl.fm/KBRi5