In a notable shift in institutional activity, U.S. spot Bitcoin exchange-traded funds (ETFs) logged approximately $239.9 million in net inflows on 6 November, ending a six-day run of net outflows. The turnaround comes amid macro turbulence—ranging from rate-cut expectations for the Federal Reserve to fluctuating risk-appetite—and signals renewed interest in regulated Bitcoin exposure.

Market Reaction

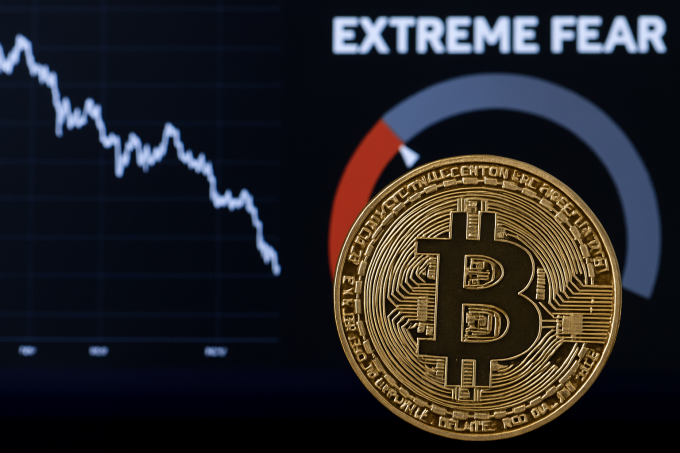

Following the six-day outflow streak—which reportedly drained roughly $2.05 billion from Bitcoin ETFs over that period, with an additional ~$837 million exiting Ethereum ETFs—investors appear to have paused net redemptions. On the reversal day, key funds such as IBIT (BlackRock) drew about $112.4 million, while FBTC (Fidelity) and ARKB (ARK 21Shares) added ~$61.6 million and ~$60.4 million respectively. From a price perspective, although this flow reversal is constructive, the broader crypto market remains jittery. Bitcoin slipped around 2.4 % to ~$100,768 despite the inflow, underscoring that positive flows don’t immediately translate to price recovery. The implication: inflows may alleviate structural liquidity drag, but they must be sustained to become meaningful in the near-term price evolution.

Regulatory and Structural Implications

The rebound underscores the growing significance of institutional channels into crypto. U.S. spot Bitcoin ETFs—predominantly managed by large issuers such as BlackRock and Fidelity—have now demonstrated that net flows can flip quickly in response to macro or sentiment catalysts. Analysts note that a floor in institutional allocation via regulated ETFs may be forming, which potentially reduces the supply of Bitcoin available in the open market. For large institutions and allocation desks, the clarity and regulated structure of these ETFs mitigate custody, compliance and benchmark-issues that plagued earlier crypto funds. This shift matters for sophisticated investors because it converts Bitcoin from a purely peer-to-peer/trading-asset play into a legitimate, allocatable asset within broader portfolios—and that structural conversion merits attention.

Investor Sentiment & Strategic Perspective

From a behavioural standpoint, the rebound suggests that risk-off flows may have paused and that long-term positioning is re-entering. Institutions appear willing to step back in after a week of cautious withdrawal—perhaps viewing the ~$100,000 level as an opportunistic entry or hedge. However, the return of flows is not yet a full-scale “buyers’ stamp.” Flow volume remains modest relative to multi-billion-dollar weekly cycles seen earlier in 2025 (when total YTD inflows exceeded $30 billion). For sophisticated investors, the key takeaway is that flows remain a useful barometer of institutional appetite—and that this data point is signalling tentative stability rather than exuberant accumulation.

The psychology at work: during outflow streaks, risk-averse players may deleverage. The abrupt reversal suggests those players believe the risk/reward trade-off is now shifting: either the macro regime is stabilising, or Bitcoin’s value-proposition is again compelling relative to other risk assets. Tracking if the inflow streak sustains—or if it fades after one day—will be crucial in judging whether this is a genuine pivot or a one-off technical bounce.

Forward-looking, the ETF flow flip puts a floor under structural liquidity pressure for Bitcoin, but significant upside still hinges on broader macro tailwinds (e.g., Fed pivot, inflation moderation) and sustained institutional follow-through. Risks remain: a return to net outflows could quickly reverse sentiment; regulatory developments (including tax/treatment of digital-asset funds) may re-introduce uncertainty; and Bitcoin still must contend with technical resistance near $112,000 to $115,000 for a meaningful breakout. For institutions and allocators, the current window may present an opportunity to monitor flow momentum and liquidity dynamics—but only in conjunction with macro, on-chain and technical signals.

https://shorturl.fm/4ws2L